New numbers show how pandemic impacts public golf

Unprecedented disruption of day-to-day business at America’s golf facilities prompted GOLFNOW to conduct surveys of golf course operators in March and April – the first concluding on March 26 and the second on April 15. A total of nearly 1,300 responses came back, divided between the two questionnaires. It will come as no surprise that difficulties identified in the first survey were described as all the more challenging in the second one.

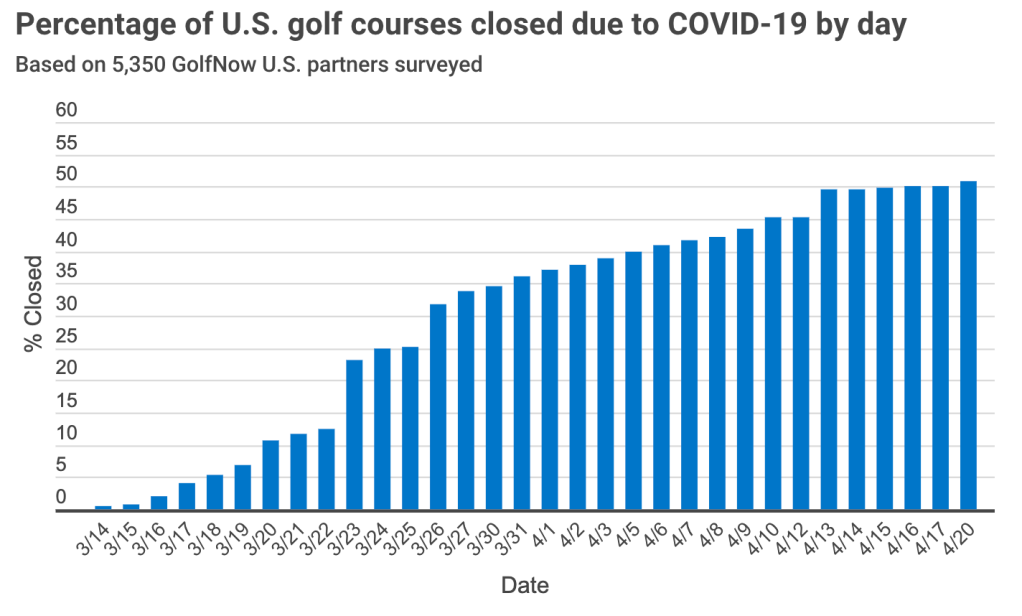

The most definitive data point covered by this research—whether the reporting facilities had closed for play—increased from 42 percent to 62 percent, in just the couple of weeks between surveys.

For many of those remaining open, manpower has been reduced by layoffs and furloughs. In the March GOLFNOW survey, 24 percent of respondents reported having laid off at least half their workers. In our April follow-up, that percentage had increased to 39 percent. Another 12 percent responding to the April survey said they had furloughed or laid off between one-quarter and one-half of their workforce.

Mild winter weather in large parts of the U.S. have combined with the shutdown of most entertainment options to actually increase early-spring golf activity in some places. That showed up in this research, with 24 percent saying, in March, that rounds played had increased over the same period in 2019. In the April survey, 15 percent said rounds were even or increased.

Changes to payment practices are under consideration at many courses, with some operators describing online prepayment as a necessity for doing business. Short-staffing has been commonplace and the need to maintain safety precautions is vital, two factors that favor the “park and play” approach and discourage in-shop payment.

A pair of questions in the April survey touched on that topic, the first one revealing that, among respondents who remain open for business, 52 percent are not accepting cash. The second question asked generally about forms of payment and provided multiple response options. A combined 17 percent said they had either “changed to online payments only” or “changed to credit card by phone only.” Six out of 10 said they were still at the golf shop counter, collecting payments and checking golfers in.

Continuing with the shutdown is, not surprisingly, a daunting prospect. When asked in April how long their course could go without green fee revenue during golf season before their business “suffers irreparable damage,” 27 percent said less than one month, 50 percent said from one to three months and the remaining 22 percent said they could go three months or longer.VIEW MARCH SURVEY RESULTS→VIEW APRIL SURVEY RESULTS →

On that basis, interest in government relief is something you would expect course operators to demonstrate. Almost two-thirds, 63 percent, said they had visited the SBA.gov website in search of information about CARES Act programs to assist small businesses in distress as a result of COVID-19 disruptions.

Projections and speculation about the country’s transition from the COVID-19 crisis to a gradually more open economy have mentioned golf as an activity more easily restarted than many others. That may be a partial reason for the fairly optimistic outlook that emerges from the April study, which concludes with the question: “What do you expect business levels to be like following the COVID-19 outbreak?”

One in three, exactly 33 percent, said business would be “about normal.” A spirited 8 percent said “much better” than before and 22 percent said “slightly better” than before. Meanwhile 29 percent felt it would be “slightly worse” than before the crisis and 9 percent said “much worse.” Researchers who produced the two studies, along with all their colleagues at GOLFNOW, wish to express gratitude to the course partners who took time to complete their questionnaires.