The year 2020 has been a roller coaster for golf facilities around the country.

After a strong start, the low point came in March and April when many facilities were forced by local and state mandates to close anywhere from six to eight weeks during the early stages of the pandemic. At that point, no one could foresee the incredible ascent the industry would experience through the summer and into fall as courses reopened and participation boomed because golf was considered one of the very few safe and accepted recreational opportunities for social distancing. This wild ride leaves many wondering what the future holds. Will golf’s momentum continue well into 2021, even after a COVID-19 vaccine? Which of the new COVID-19 protocols could become permanent industry practices?

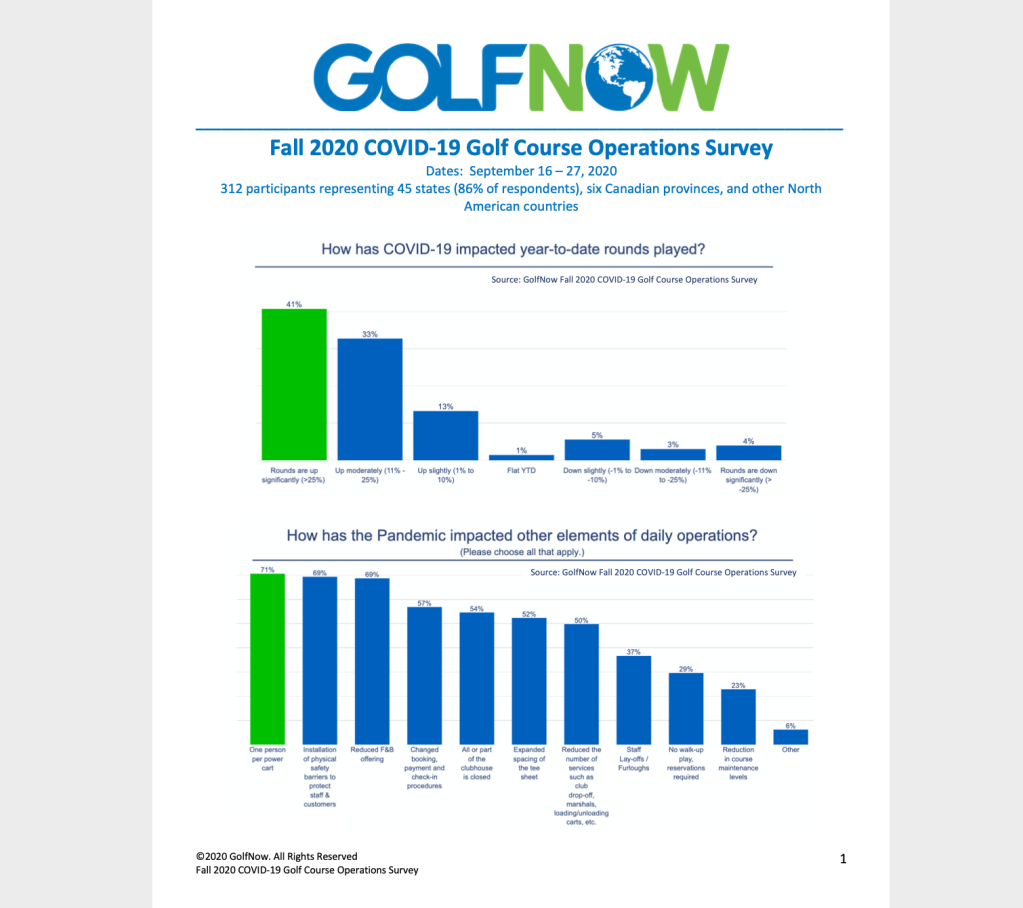

The 2020 Golf Operation Impact survey by GolfNow might help owners and operators better understand the pandemic’s long-term impact on the game. More than 300 owners and managers, mostly from public and semiprivate clubs, responded to the anonymous survey, representing 45 states, six Canadian provinces and several international properties, as well.

The 2021 outlook is generally positive based on the survey results, despite some stumbling blocks in certain segments. Two-thirds of the respondents are “very optimistic” that golf will be able to capitalize on the surge of interest and newcomers to the game. Roughly 51 percent of respondents agree, at least somewhat, that the pandemic is a new “silver lining” for the game of golf, and 46 percent of respondents disagreed with the statement that the new interest in golf will be “short-lived.”

“We remain positive for the future and we have learned a lot in 2020,” reads a comment from one survey participant. “The golf industry will have a great year in 2021. I am convinced with the generation of 25/35 (year-olds) who have just discovered golf. Our industry will do well.”

That cheery outlook is being fueled by the more than 81 percent of facilities that reported rounds increased year to date (through September), including 36 percent where revenue was up more than 25 percent during the peak summer season. More golfers meant big summer revenue gains in many categories compared to last year – green fees (77%), cart fees (70%), pro shop (36%), on-course F&B (34%), instruction/lessons (26%) and clubhouse F&B (22%).

Not every part of the business is thriving, however. Unfortunately, for those with wedding/events businesses, 74 percent have virtually seen their bookings vanish. The group/outing business was down 86 percent at all facilities. Resort courses, which rely on traveling golfers staying in hotels, aren’t feeling a sunny 2021 forecast: 31% are not at all optimistic.

More than half of the respondents (54%) spent the spring and summer without their second-biggest asset – the clubhouse. Roughly 69 percent had reduced F&B operations. 75 percent of courses began to offer grab-and-go choices to boost sales, with one operator noting that building a new snack “shack” at the turn was an innovative way to solve the problem.

“Keeps people from going inside,” the anonymous comment read. “They like it and cannot miss it (drive right past it). Keeps pace of play moving also. No bar open and beer sales are up 20% this year. Partly due to more players, but mostly due to making it easy for people to grab it before they start and at the turn.”

How to distribute carts while keeping riders safe has been a polarizing issue from the onset. 71 percent of facilities went to single-rider carts, a trend worth keeping an eye on. Players with their own carts have loved what amounts to a bump in pace-of-play, but the practice puts a strain on facilities that only have a limited supply available. The extra cart traffic is hard on the turf, as well.

With an eye toward the future, more facilities may begin utilizing technology more than ever before. Pre-COVID, only 4 percent of facilities said technology investment was important. That number nearly tripled to 11 percent. Almost half (47%) now believe technology is a priority, up from 27 percent pre-pandemic.

Some facilities went to prepaid tee times to promote “contactless” check-in, with 31 percent saying it will become a standardized feature moving forward. 54 percent are still undecided.

Although in-person check-in (96%) and in-person credit card payments (89%) remain standard procedures, online (85%) and mobile (81%) tee time bookings are outpacing in-person bookings (74%).

“The ability to book online was great. So glad we invested in GolfNow late last season” wrote one operator. “… we were ahead of a lot of other courses that didn’t have that ability.”